I am meeting with new clients this weekend about selling their lovely home. The odd thing is that they just bought this home a few months ago. I do not have all the details as of yet, but I do know that my new clients bought the house site unseen and moved here from 900 miles away. They utilized one of our national consumer real estate websites to buy the home and the listing agent's office was in Seattle 160 miles away from here.

I won't opine any further on this specific case, but in general my belief is that national websites such as Zillow, Redfin, Trulia, etc. are excellent tools for people searching for homes especially when looking at far away destinations. That is where their practical benefit ends however. There is no substitute for a local pro that understands the nuances of neighborhoods and the other important issues that face homeowners in a new region.

Once a buyer thinks they have narrowed it down to a few homes they want to see, or even offer on, a local pro should be contacted other than the listing agent. It is important not only to have a local agent that understands the local market, but also an agent unaffiliated with the seller. A listing agents greatest obligation is to the seller for which he has a signed contract with statutory language. The listing agent will pay the buyer's agent commission so the buyer is in much better shape using their own agent.

It is important to take the time to ensure you are buying the best house for you at the best price possible and with favorable terms. Buying a home and then having to sell it three months later is rarely a profitable exercise. Buyers need to be sure they have all the proper information before buying a house.

If you find a home on one of the national websites, there are usually buyer's agents listed. Sometimes there will be a preferred or premier, et al. agent. These agents have likely paid the company money for placement. There may also be a few random agents listed that have a profile on the system and list that area as their area of expertise. Be sure to visit the agent's profile before contacting them.

There is no better asset to a home buyer than a local professional looking out for the buyer's best interests, not the seller's.

Friday, October 28, 2016

Friday, October 21, 2016

Selling in the Mountains in the Winter

|

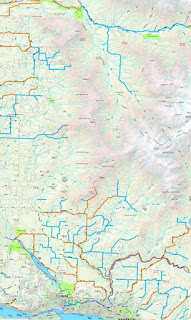

| Snow on ground at 850 feet, no snow in Vancouver on this day |

Down in the valleys of Vancouver and Portland snowfall is far less common than rain. Locally Vancouver averages about 6 inches a year at Pearson field. But averages are deceiving. There are years that have no snow at all and others that have heaping amounts. Meanwhile, up in the mountains things are more defined. Above a thousand feet it is not a case of if it snows, but rather, how much snow will there be.

Buyers should keep this in mind as well. Many people are looking for a rural home on some acreage. As one moves east generally things start to climb in elevation. Clark County's entire eastern flank is the Cascades with elevations rising up to about 4000 feet before spilling into Skamania County.

When seeking a home up at elevations in the 1000-2000 range which is about as high as you'll find a home in the county, there are a few things to consider. Most higher elevations above 2000 feet are part of the Washington State DNR or the Gifford Pinchot National Forest which do not contain developed neighborhoods.

|

| East County Snow Routes |

Since those monster events are so rare, the county keeps a modest amount of equipment for winter snow removal. Usually most snow events are well handled by the county crews. Those 'snowzilla' events however, will leave the roads snow covered and dangerous. The primary and secondary routes are important if home buyers do not wish to traverse hard-packed, snow-covered roads on a regular basis. Clark County has a published chart showing the snow removal routes for rural areas.

Consider carefully properties that are more than a quarter to half a mile off one of these snow removal routes as travel can be perilous in the mountains when it snows. Remember it may be raining in Vancouver and snowing up in the foothills.

Additional families with school age children should consider school district rules for snow. Generally a wide spread snow event with even modest amounts of snow can trigger a school closure. For mountain dwellers however there will be many days in which schools remain open because it's raining in the valleys and snowing up high. On those days, school buses often run special "snow routes". These will keep buses off the steep terrain and require that parents get the kids to the snow route bus stop on their own. These are things to consider when buying a home above 1000 feet.

It should be noted that most of the time areas between 800-1200 feet don't get huge amounts of snow all at once unless it's during one of the every five years 'snowzilla' event. What happens up around 800-1200 feet is that there is simply more snowy days. 1-2 inches in Vancouver might equate to 3-5 inches at 1000 feet. But there will be 3 to 4 times as many snowy days and as the elevation rises so rises the number of times per year snow falls. Also up above 1000 feet the snow tends to stick around longer than it does down in the valleys.

I would like to note that none of Clark County's incorporated urban areas exceed 800 feet in elevation. The high spot is probably Prune Hill in Camas at just under 800 feet. It is the rural country areas in the Cascade foothills that can be up close to 2000 feet. Buyers worried about snow but looking at traditional suburban or urban neighborhoods need not worry about heavy snow outside of the rare events.

Friday, October 14, 2016

Will the Fed Raise Rates in December?

Once the election is over, the Fed will decide what to do about these unprecedented low interest rates. Many analysts are suggesting a rate increase is eminent. This is a concern for many people. If they do raise the Fed rate it will have a negative impact on the mortgages but not horribly so. The Fed is smart enough to know that small incremental increases are the only way to 'safely' raise rates. That said if they are going to raise the rates, is it not wise for those thinking about a refinance or a home purchase to act now, rather than later?

Our market is still seeing a price appreciation. It is not a rapid appreciation like we saw last year and into this spring, but it is rolling along at a sustainably healthy 4-6% annually. So people lallygagging around in the housing market will see the price of homes rise by about 1/2 percent monthly and could see an average mortgage rate increase of 1/4 to 1/2 percent by the end of the year if the Fed raises rates.

Paying more for a house and more interest is not a good combination. Those thinking about a home purchase should strongly consider making their move now. Even if the Fed sits on rates, the monthly price appreciation marches on. The difference of 0.5% seems minor, but that is $1500 on a $300,000 home every month! A quarter point to interest rates will add thousands over the life of the loan. Why not act sooner, rather than later?

Those who are not able to buy now but may be working toward that goal, worry not, rates could go up by two FULL percentage points and still be lower than the 50 year average. It isn't the end of the line if the Fed creeps the rate up a little. In fact it is long overdue. If however a buyer is sitting out there waiting and they are capable of buying now, the waiting serves no real purpose. Below is an excerpt from a past blog post that draws from references I made in my 2010 Book, Don't Panic.

"Many buyers qualified to buy a home a few years ago, but they allowed market fear to get in the way and they hesitated. Now the market has passed them by. When considering an owner occupied property, the time to buy is nearly always now. Yes exceptions are true, buying in late 2007 was not ideal, but one always needs a place to live and even those who bought at the peak before the great crash, still had a home to live in and those folks are now seeing all their equity return. While the home was financially "underwater" it still served its purpose as a shelter. In the grand scheme of things the only bad thing about the value decline was that it limited the ability to sell.

Too many people put too much into the "investment angle" of the home they buy to live in. Yes, we always want to make a sound investment. But unless you are renting out every extra inch of that house, you are not maximizing your investment. I did not buy the house I live in as an investment, I bought it to provide shelter for my family and to use it for my own needs. Its value is not important until I decide to sell it or leverage it. As a real estate professional I do tend to look at the investment side of buying a house even when I intend to live in it, but I never let the investment potential or lack there of, be the overriding factor in the purchase. The primary concern is its use value. Investment potential is supplemental at best."

Home ownership is an important part of our American economic system and both political parties seem to get that. It is one of the few issues in which we have a non-partisan consensus. If you are able the time to act is now.

Our market is still seeing a price appreciation. It is not a rapid appreciation like we saw last year and into this spring, but it is rolling along at a sustainably healthy 4-6% annually. So people lallygagging around in the housing market will see the price of homes rise by about 1/2 percent monthly and could see an average mortgage rate increase of 1/4 to 1/2 percent by the end of the year if the Fed raises rates.

Paying more for a house and more interest is not a good combination. Those thinking about a home purchase should strongly consider making their move now. Even if the Fed sits on rates, the monthly price appreciation marches on. The difference of 0.5% seems minor, but that is $1500 on a $300,000 home every month! A quarter point to interest rates will add thousands over the life of the loan. Why not act sooner, rather than later?

Those who are not able to buy now but may be working toward that goal, worry not, rates could go up by two FULL percentage points and still be lower than the 50 year average. It isn't the end of the line if the Fed creeps the rate up a little. In fact it is long overdue. If however a buyer is sitting out there waiting and they are capable of buying now, the waiting serves no real purpose. Below is an excerpt from a past blog post that draws from references I made in my 2010 Book, Don't Panic.

"Many buyers qualified to buy a home a few years ago, but they allowed market fear to get in the way and they hesitated. Now the market has passed them by. When considering an owner occupied property, the time to buy is nearly always now. Yes exceptions are true, buying in late 2007 was not ideal, but one always needs a place to live and even those who bought at the peak before the great crash, still had a home to live in and those folks are now seeing all their equity return. While the home was financially "underwater" it still served its purpose as a shelter. In the grand scheme of things the only bad thing about the value decline was that it limited the ability to sell.

Too many people put too much into the "investment angle" of the home they buy to live in. Yes, we always want to make a sound investment. But unless you are renting out every extra inch of that house, you are not maximizing your investment. I did not buy the house I live in as an investment, I bought it to provide shelter for my family and to use it for my own needs. Its value is not important until I decide to sell it or leverage it. As a real estate professional I do tend to look at the investment side of buying a house even when I intend to live in it, but I never let the investment potential or lack there of, be the overriding factor in the purchase. The primary concern is its use value. Investment potential is supplemental at best."

Home ownership is an important part of our American economic system and both political parties seem to get that. It is one of the few issues in which we have a non-partisan consensus. If you are able the time to act is now.

Friday, October 7, 2016

Leaves are Coming Down! Fall is Here.

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.It seems like a simple thing but buyers need to have a positive experience when they pull up and then walk up to the house. Getting a soaking at the hands of a clogged gutter sets a negative tone before they even set foot in the home. We never want a negative tone now do we?

The further we march into the cooler, wetter autumn and ultimately the colder and icy winter the more serious buyers braving the elements are. Buyers need to look past the little stuff, but sometimes they don't. Sellers need to pay attention to details to maximize value and bring the highest offer.

Autumn is a truly magnificent time of year and real estate can be quite robust during this period. although the volume drops a little, buyers are more serious and inventory is a little tighter so it is about equal in as far as supply and demand is concerned.

I mentioned in previous posts that the market is still climbing but the steep price appreciation has moderated substantially. I believe this is a healthy condition.

Interest rates have been very low over the last several weeks even by recent standards but they seem to be yo-yo-ing up and down in the threes. Loan officers have to pay attention so as to lock buyers in on one of those fabulous lows in the cycle. In general this is still a great opportunity for buyers. Although buyers may wax nostalgic for the low prices of 3-5 years ago these low rates are amazing and that will ultimately save buyers tens of thousands of dollars over the life of the loan.

Subscribe to:

Posts (Atom)